Pricing Research 101: Setting the Right Price for Market Success

Trying to pin down the optimal price for your product can make you feel like you need an advanced economics degree, doesn’t it? With competitors playing games and budgets still recoiling from recent hits, one wrong move could severely impact your growth trajectory. But rest assured—proven pricing research methodologies can transform the guesswork into a clear strategic compass.

3 Pricing Research Methodologies for Pricing Your Products and Services Right

In this blog post, we’ll explore three pricing research frameworks—Gabor Granger, Van Westendorp, and Conjoint Analysis—that guide your pricing strategy by illuminating the sweet spot where profits and demand converge.

You’ll learn how each methodology approaches pricing intelligence from a different angle, capturing a 360-degree view of your market’s priorities. With market-validated data removing the risk of missteps, you can precisely tune your pricing dials to accelerate revenue velocity within your competitive landscape.

So, set aside those stress-inducing spreadsheets! It’s time to uncover your perfect price point through savvy pricing frameworks that do the heavy data lifting for you. Let’s get started!

Gabor Granger Methodology: Estimating Price Elasticity

In a volatile market, the Gabor Granger Method is your elasticity seismograph - revealing demand fluctuations resulting from pricing adjustments before they can undermine your revenue foundation.

A short video explaining the Gabor-Granger Price Strategy

The Elasticity Expert

Armed with the price-demand function, the Gabor Granger method reveals precisely how demand elasticity shifts at various price points. It pinpoints the peak price where revenue can be stretched without snapping consumer loyalty.

Intelligence Through Hindsight

By scrutinising past price tweaks and resulting customer behaviors, this methodology charts the optimal cost ceiling before volumes plunge, relying on robust records to expose the elastic limit.

Fine-Tuning With Finesse

Need to tweak your price dial slightly? The Gabor Granger method quantifies subtle shifts in elasticity from minor adjustments, detecting when small changes yield outsized gains or losses. Perfect for precision moves.

2. Van Westendorp Pricing Research Methodology: Unveiling the Optimal Price Range

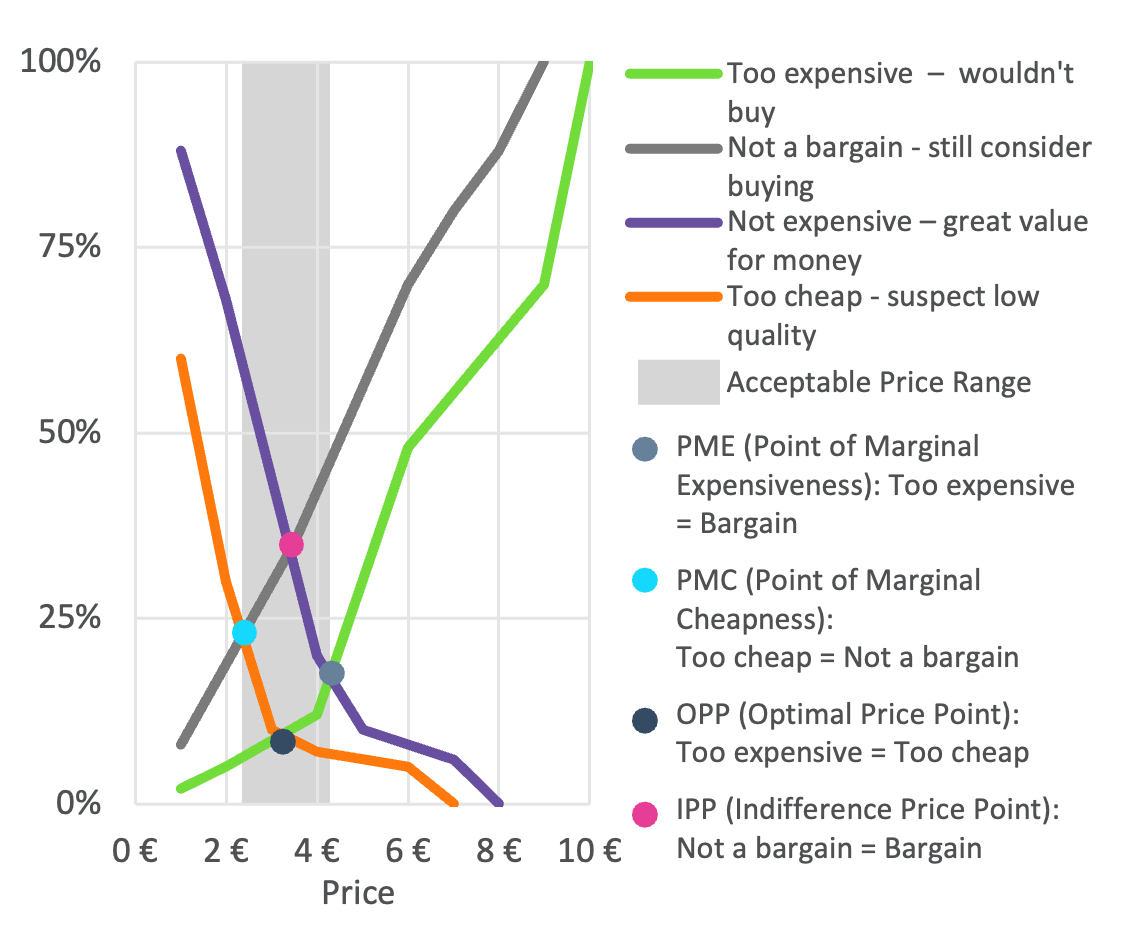

The Van Westendorp method is a survey-powered spotlight revealing the pricing sweet spot where value perception and willingness to pay converge. By polling consumers to determine what they consider a bargain versus what they find too steep, it maps out the strategic high ground for maximising appeal.

A short video explaining the Van Westendorp Price Sensitivity Meter (PSM)

Quantifying Perceived Value

The Van Westendorp method surveys consumers directly to establish perceptions of price fairness and product worth, eliminating guesswork. This clear quantification of value metrics spotlights pricing alignment.

Context-Based Price Targeting

By arming you with metrics for ideal cost, expensive, and cheap price points, this methodology exposes the context-based pricing range that will resonate best with your audience.

Appeal-Testing for New Products

Uncertain how to accurately price a new offering pre-launch? The Van Westendorp method surveys consumer willingness to pay, providing empirical data on perceptions. This testing helps determine pricing for maximum appeal.

For pricing that allures rather than alienates, the Van Westendorp method illuminates the bullseye price bracket tailored to your audience. Gain the context you need to attract and retain loyal customers.

3. Conjoint Pricing Research Methodology: Revealing Product Attribute Importance

Conjoint analysis is a reconnaissance mission, uncovering which product attributes drive purchase appeal and which are non-essential add-ons. By surveying consumer reactions to hypothetical product variants, it exposes the most influential features to emphasize when optimising pricing strategy.

A short video explaining Conjoint Analysis

Attribute Importance Testing

By surveying reactions to hypothetical product variants, Conjoint Analysis maps the relative value consumers assign to each attribute, such as quality, branding, specs, and more. This pinpoints where to focus innovation efforts for maximum appeal.

Preference Dissection

Conjoint Analysis presents product scenarios with different attribute mixes and then dissects how combinations impact preference and purchase interest. This exposes synergies between features and identifies ideal configurations.

Pricing for Complex Products

For products with multiple attributes, Conjoint Analysis quantifies the specific monetary value consumers perceive in each component. This intelligence allows accurate pricing of intricate offerings based on data-driven attribute worth.

When feature priority is unclear, Conjoint Analysis provides clarity by spotlighting the attributes to perfect and amplify when engineering both irresistible products and maximising profits.

When to Use Which Methodology

Wondering which pricing research methodology packs the perfect pricing intel for your situation? We’ve got you covered—here’s when to deploy each approach.

Gabor-Granger

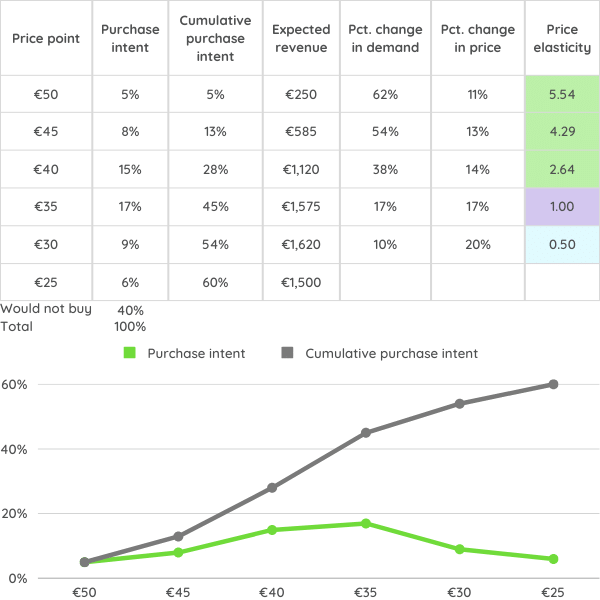

With a clear idea of the price range, the Gabor-Granger method provides actionable insights by measuring price elasticities and estimating revenue. This approach is ideal for precisely adjusting established pricing strategies and understanding the broader revenue implications.

Price test with Gabor-Granger

Used to identify price elasticity, predict estimated revenues and understand how price changes affect sales volume

The product is already introduced in the market

Aim to optimise and predict revenue/profit

Market shares of competitors should be estimated

The data is processed using an inverse cumulative distribution to uncover price elasticity of demand

The results show the total proportion of customers willing to buy the product and the revenue-maximising price

Price elasticity with Gabor-Granger

Van Westendorp

Entering unfamiliar territory with a new product launch? Van Westendorp surveys offer empirical compass readings on consumer willingness to pay, regardless of past reference points. This enables accurate targeting of uncharted segments.

Price test with Van Westendorp

There is not an established price for the product (e.g., new product, or new market)

Actual demand not predicted at specific price points

Determine how much consumers are willing to pay

The product is ready, the only thing that can change based on the results is the price

The results identify a range of acceptable prices, the Optimal Price Point is not the only possible “best” price

The Van Westendorp price model

Conjoint Analysis

Dealing with a complex product that combines multiple attributes? Conjoint Analysis quantifies consumer preferences to reveal which features impact willingness to pay and by how much. Well-suited for decoding pricing for intricate offerings.

Price test with Conjoint Analysis

Understand the importance of price relative to other attributes (e.g., price, color, brand, size)

Identify the impact of attributes on consumers perceived value of the product and their desired combination

Uncover market shares, also of competitor brands, and purchase intent for different options

The research can be done as a choice-based conjoint or an adaptive choice-based conjoint

Product attributes and attribute levels should be predefined

Conjoint price analysis

Conclusion

Pricing research serves as the compass guiding businesses toward growth horizons. Without it, risk and uncertainty cloud the path.

As we have explored, the Gabor Granger method, the Van Westendorp method, and Conjoint Analysis offer clear methodological lenses to transform pricing guesswork into confident strategic clarity.

With three pricing research methodologies tailored to diverse pricing scenarios, you can extract the perfect intelligence to alleviate the stress from your strategic decisions. Choose your approach wisely and set your product up for market success!

Want to learn more about how market research can help you succeed in a competitive marketplace?

Check out our blog post, ‘The Ultimate Guide to Mastering Consumer Insight and Market Intelligence: Navigating Today's Competitive Landscape’.

How our pricing study optimised revenue potential for Tyson Foods

“The survey results are very interesting, we got a clearer picture of the category consumers, how our brand performs and how to improve the brand performance with marketing communication. We also saw clear indications that we can optimise the base price per unit. We will be using the results to adjust the target groups for the digital marketing campaigns."

Tjerk Boorsma

Marketing Intelligence & Consumer Insights Specialist